Angolmois: Genkou Kassenki - The final episode of the season is out! Watch Angolmois: Record of Mongol Invasion Episode 12 here: https://got.cr/2Q7Tl5v | Facebook

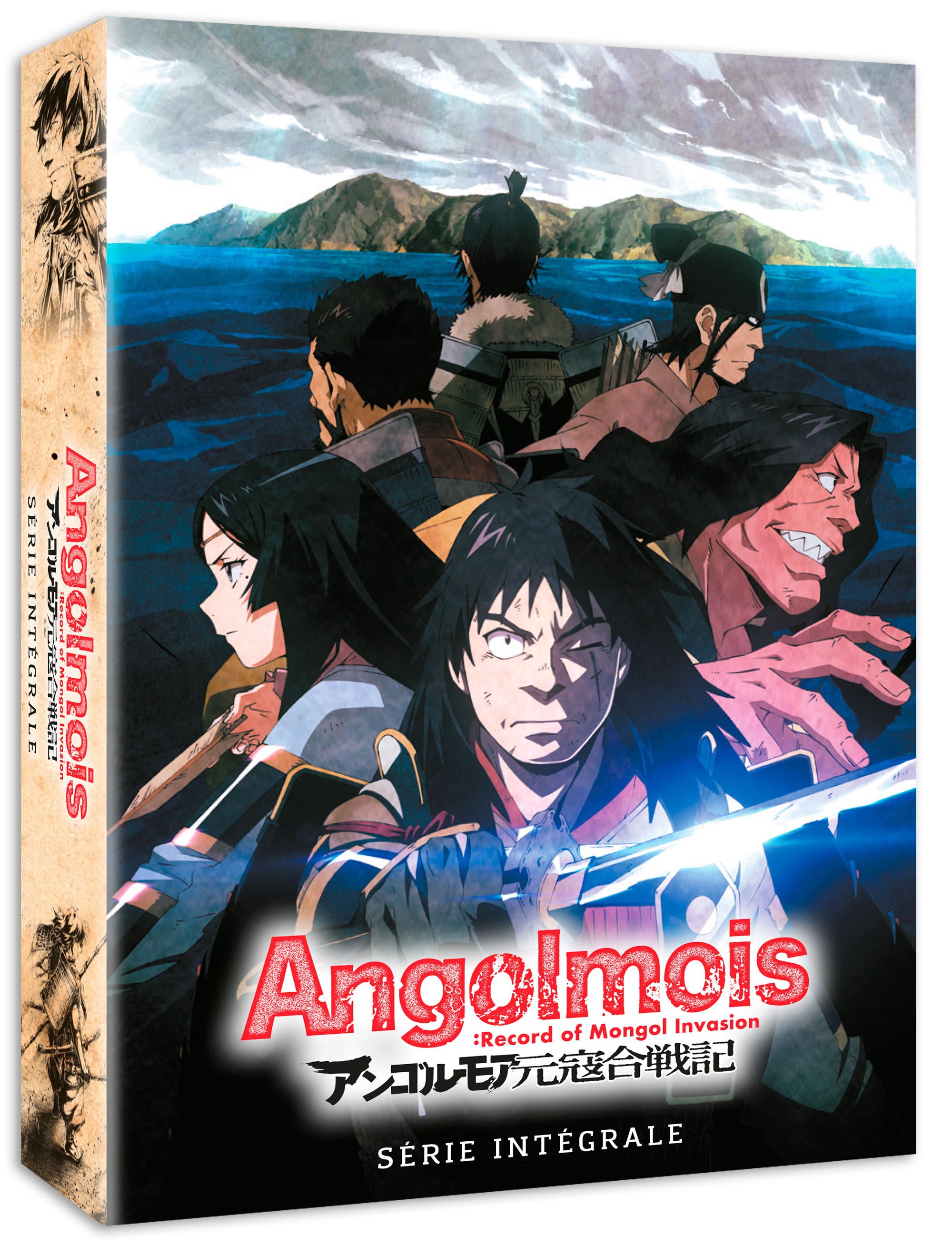

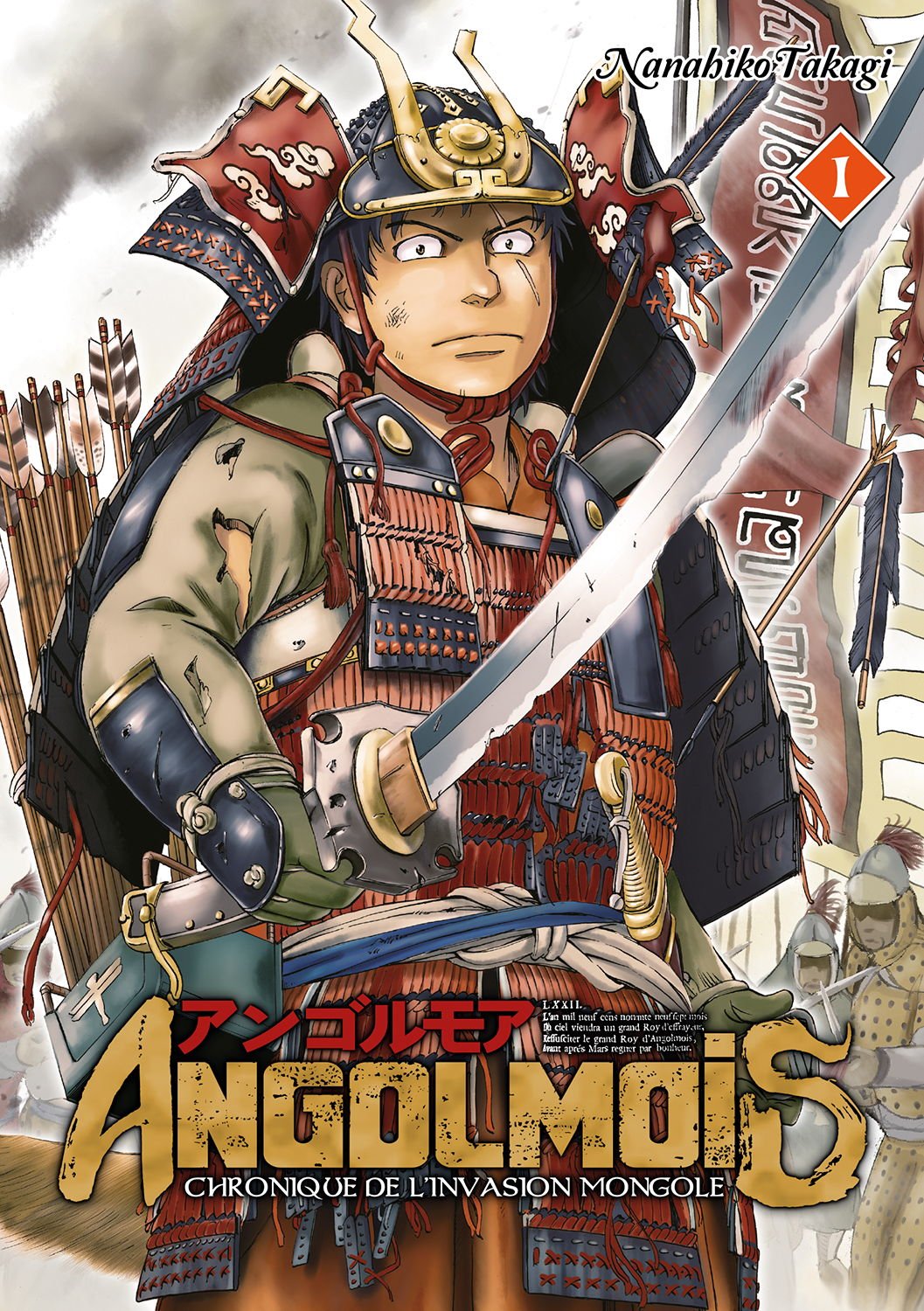

ANGOLMOIS GENKOU KASSENKI épisode 1-12Fin japonais Anime DVD livraison gratuite EUR 22,26 - PicClick FR

ANGOLMOIS GENKOU KASSENKI épisode 1-12Fin japonais Anime DVD livraison gratuite EUR 22,26 - PicClick FR